In today's fast-paced world, where time is of the essence, Shory has revolutionized the car insurance buying experience for its users. As a leading UAE-based Insurtech, Shory offers a no-spam, no-paperwork solution for obtaining instant car insurance at the most competitive prices. Whether you're a proud owner of a GCC car or a non-GCC vehicle, Shory's intuitive website and user-friendly app make the entire process seamless and stress-free. In this guide, we'll walk you through the essential steps to secure the best car insurance online through Shory.com.

Step 1: Log on to Shory's Website or Download the App

Visit Shory's user-friendly website or download the intuitive app from your preferred app store. Creating an account with Shory is quick and straightforward, ensuring you're ready to embark on the journey to hassle-free car insurance.

Step 2: Select Your Vehicle Type

Navigate to the 'Car Insurance' tab and choose the type of vehicle you want to insure – GCC or non-GCC. Shory caters to a diverse range of vehicles, ensuring that your insurance needs are met efficiently. The steps below contain details of how to buy plans for a GCC spec car.

Step 3: Choose Your GCC Car Type

If you opt to insure a GCC car, Shory provides three options: a car you already own, a used car you plan to purchase, or a car with no registration. Select the appropriate option based on your situation and move on to the next step.

Step 4: Enter Your Emirates ID

In the subsequent step, enter your Emirates ID to initiate the insurance process. Shory's platform is designed for efficiency, and some details may be pre-filled, simplifying the overall process.

Step 5: Provide Vehicle Details

Enter essential vehicle details, including plate source, plate code, and plate number. While some information may auto-populate from your Emirates ID, ensure that all details are accurate and complete.

Step 6: Specify Car Value

Follow the prompts to enter the estimated value of your car. Shory uses this information to tailor insurance plans that suit your needs and budget.

Step 7: Select Years Without Claim

Indicate the number of years without a claim, and if eligible, choose the appropriate no-claim discount option. Shory values your history and rewards you for safe driving.

Step 8: Choose Policy Start Date

Select the start date for your policy, providing flexibility and convenience. Click on 'Get Quote' to move forward in the process.

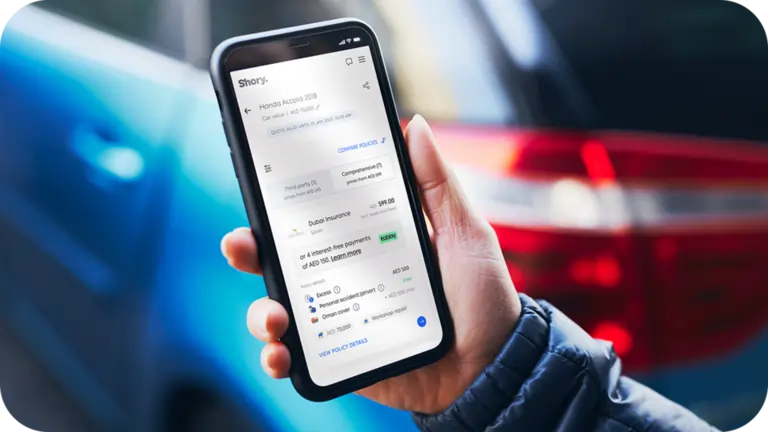

Step 9: Explore Insurance Plans

On the next screen, Shory presents comprehensive and third-party car insurance plans for your consideration. Take the time to review each plan and choose the one that aligns with your preferences and requirements.

Step 10: Compare Policies

For an informed decision, use Shory's comparison tool to evaluate coverage options and understand what each plan offers. This step ensures transparency and empowers you to make the right choice.

Step 11: Make Payment

After selecting your preferred car insurance policy, proceed to make the payment securely. Shory accepts payments via card or offers the convenience of four interest-free installments.

Step 12: Instant Policy Issuance

Congratulations! Upon successful payment, Shory issues your car insurance policy instantly. No waiting, no paperwork – just efficient, instant coverage.

Conclusion

Shory's commitment to providing a streamlined car insurance purchasing experience sets it apart in the Insurtech landscape. By following these twelve easy steps, you can secure the best car insurance coverage tailored to your needs promptly. Experience the future of insurance with Shory – where simplicity meets security.