Did you know that finding the involves more than just a quick online search? UAE motor vehicle laws are quite strict – every vehicle on the road must have at least third-party insurance. The penalties for driving without coverage are severe, including hefty fines, license suspension, and in some cases, even imprisonment.

But don't worry – you don't need to empty your wallet for proper coverage. That's why we've developed our car insurance comparison platform at Shory. Our online tools have made it easier than ever to shop for policies in the UAE. Whether you're looking for full comprehensive coverage or the cheapest third party car insurance in UAE, our digital comparison tools help you evaluate multiple options in minutes instead of hours.

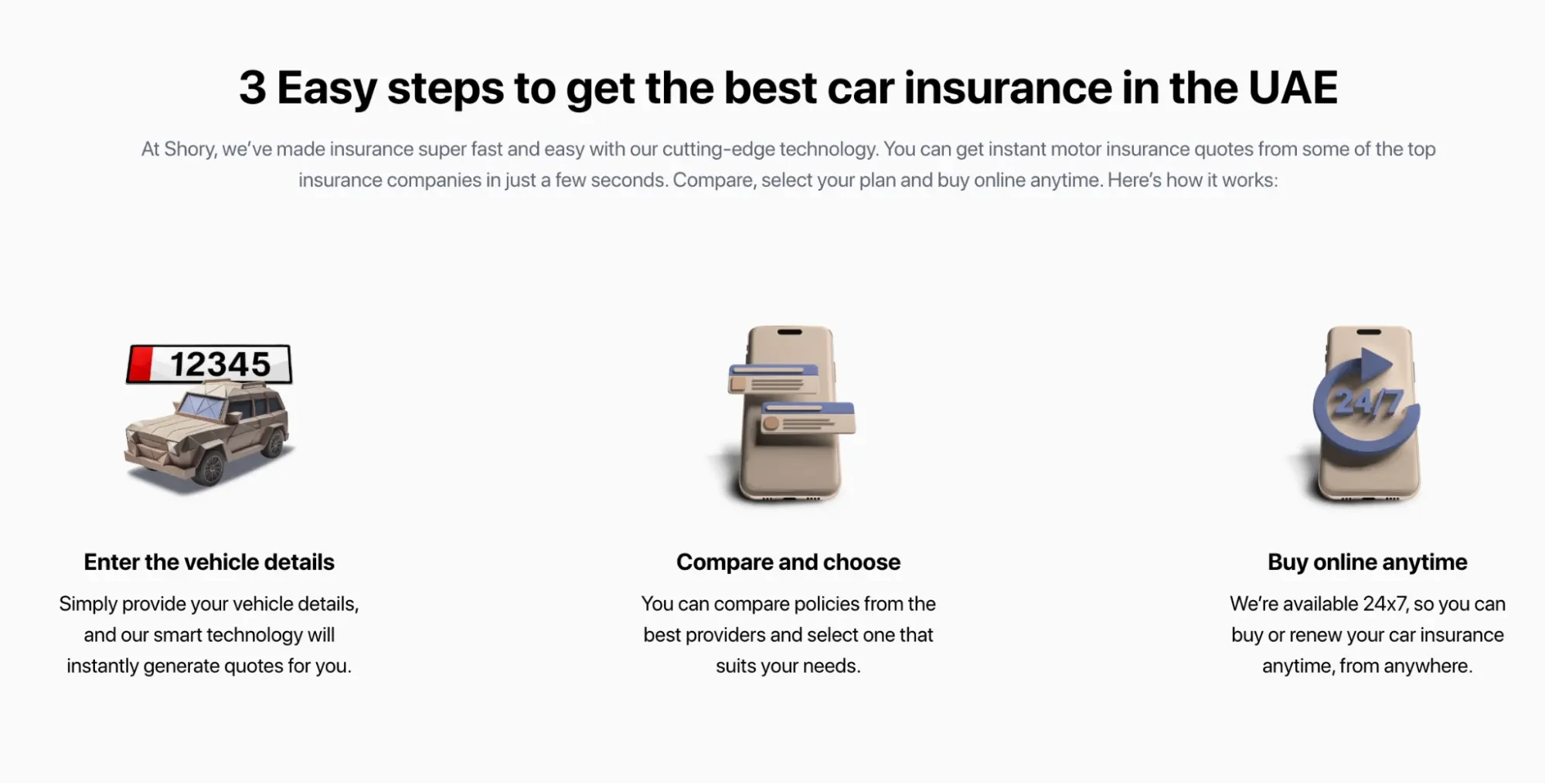

At Shory, we've partnered with leading insurance providers including Abu Dhabi National Takaful, Qatar Insurance, and Dubai Insurance Company to bring you the most competitive rates. Here's how you can make the best of our platform:

Quick Access to Quotes: Simply enter your Emirates ID number and vehicle details through our car insurance online platform, and you'll instantly receive personalized quotes tailored to your specific needs.

Hidden Savings Opportunities: Many people aren't aware that insurance providers often offer significant discounts for safe driving records, anti-theft device installation, or bundling multiple policies. These savings can substantially reduce your premium costs – but only if you know where to look.

In this guide, we'll walk you through everything you need to know about comparing car insurance quotes in the UAE, helping you secure the best coverage at the most competitive rates for 2025. With Shory by your side, finding affordable and reliable car insurance has never been easier!

Know What You Need Before You Compare

Before using car insurance comparison tools in the UAE, it's essential to understand what coverage you actually need. In the United Arab Emirates, you'll find two primary insurance types: Third-Party Liability and Comprehensive Insurance.

Third-Party Liability insurance represents the for all UAE drivers. This basic coverage protects you financially against: minimum legal requirement

-

Damages to other vehicles or property in accidents you cause

-

Bodily injuries or death of third parties

-

Legal liabilities arising from accidents

Comprehensive insurance offers significantly broader protection. While more expensive, it covers everything third-party does plus damage to your own vehicle from accidents, theft, fire, vandalism, and natural disasters. For newer or valuable vehicles, comprehensive insurance typically provides better peace of mind despite the higher premium.

We've noticed that many drivers benefit from adding extra protection to their basic policies. Popular add-ons include roadside assistance, personal accident cover for drivers and passengers, Oman extension, car rental coverage, and natural perils protection. Engine protection proves particularly valuable in flood-prone areas, while agency repair ensures all work is completed at authorized dealerships using genuine parts.

When looking for the cheapest car insurance in UAE, consider these factors before comparing quotes online:

-

Vehicle age and value -older cars (7+ years) may only qualify for third-party coverage

-

Driving habits and risk tolerance - analyze your specific needs rather than opting for unnecessary coverage

-

Budget constraints - third-party is more affordable but offers minimal protection

-

Regional considerations - if you travel to Oman regularly, that extension might be essential

Making informed decisions about coverage needs first means you'll save time when using car insurance online platforms. The cheapest third party car insurance in UAE might seem attractive initially, but comprehensive protection often provides better value considering UAE's traffic conditions and weather-related risks.

With Shory, we help you navigate these choices easily, ensuring you get exactly the coverage you need without paying for extras that don't match your specific situation.

How to Compare Car Insurance Quotes Online

Comparing car insurance quotes online has become incredibly easy. Thanks to digital technology, you can now compare multiple options within minutes instead of spending hours calling different providers. We've made the process simple and efficient to save you both time and money.

The first step is choosing a reliable comparison platform. While many websites offer this service, not all provide the same level of transparency or access to leading insurers. Here's how you can make the best of your comparison experience:

-

Focus on coverage before price - Don't jump straight to the premium amount. First, understand what each policy actually covers. This approach helps you avoid being misled by artificially low prices that offer inadequate protection.

-

Check against your current policy - If you already have insurance, compare new insurance quotes with your existing coverage. Are you getting the same protection, less coverage, or enhanced benefits?

-

Look beyond what's included - Understanding what isn't covered is just as important as knowing what is. Each policy has specific exclusions that could significantly impact your protection when you need it most.

-

Explore available add-ons - These optional extras can tailor coverage to your specific needs. Consider which ones are essential for your situation.

-

Hunt for discounts - Many insurers offer significant reductions for safe driving records, no-claims history, and other factors that can substantially lower your premium.

Customer reviews provide valuable insights into real-world experiences with insurance companies. Pay special attention to comments about claim settlement processes and customer service quality, as these aspects truly matter when you actually need to use your insurance.

Remember that the cheapest car insurance in UAE isn't necessarily the best choice for your needs. Comprehensive policies typically offer superior protection despite higher premiums. Many companies provide tiered coverage (bronze, silver, gold) or comprehensive packages with optional add-ons.

Once you've found suitable options, most platforms allow immediate purchase through secure checkout systems. Need more guidance? Insurance advisors are typically available via phone or email to help you make your final decision. With Shory, we've streamlined this entire process to help you find the perfect balance of coverage and cost.

Tips to Get the Best Deal in 2025

Finding the cheapest car insurance in UAE goes beyond simply comparing quotes. The 2025 insurance landscape offers several smart approaches that can help maximize your savings. Let's explore how you can secure the best rates possible.

Did you know that your driving history directly impacts your premium? Maintaining a clean driving record pays off substantially. Insurance companies reward safe drivers with a 10% discount for one claim-free year, 15% for two years, and an impressive 20% discount for three consecutive years without accident-related claims. This no-claims discount not only benefits your wallet but also encourages better road safety habits.

Loyalty matters too. Many companies offer a 10% loyalty discount when you renew with the same provider. If you're looking for even greater savings, consider bundling your policies. Some insurance providers offer up to 22% discount when combining car insurance with home insurance.

When choosing your deductible amount, remember this simple rule: higher deductibles mean lower premiums but greater out-of-pocket expenses if you file a claim. Deductibles typically range from AED 367 to AED 734, with the most common choice being around AED 1,836. Make sure to assess your driving habits and financial situation before making this decision.

The good news is that payment options have improved significantly in 2025. Many insurers now offer zero-interest installment plans over 3-6 months through participating banks. This flexibility makes comprehensive coverage more accessible without putting a strain on your monthly budget.

Here are additional strategies to help you secure the best deal:

-

Shop around extensively: Never accept your first quote - compare at least 3-5 different providers

-

Trim unnecessary add-ons: Remove coverage like off-road or GCC-wide protection if you only drive locally

-

Be accurate with vehicle valuation: Declare the correct market value, accounting for 15-20% annual depreciation

-

Look for seasonal deals: Check for promotions during Ramadan and holiday periods when companies often offer special rates

-

Set renewal reminders: Avoid late penalties that can increase your premiums

At Shory, we're dedicated to helping you find the perfect balance between comprehensive coverage and affordable rates. Using our car insurance comparison tools while applying these tips will ensure you secure optimal protection at competitive rates in 2025.

So, if you're looking to save on your car insurance this year, make sure to implement these strategies before making your final decision. Your wallet will thank you!

Conclusion

Finding the right doesn't have to be complicated or expensive. Throughout this guide, we've shown you how comparing car insurance quotes can save you both time and money while ensuring you get the coverage you need. Whether you choose third-party or comprehensive insurance, understanding your specific needs is the first step toward making smart decisions.

Remember, looking beyond just the price tag is crucial when comparing policies. The cheapest car insurance in UAE might not always provide the value you expect. Quality coverage, excellent customer service, and efficient claim settlement processes are equally important factors to consider.

What's more, maintaining a clean driving record, staying loyal to your insurer, and selecting appropriate deductibles can significantly reduce your premium costs in 2025. These strategic approaches help you balance protection with affordability.

At Shory, we're dedicated to making your car insurance shopping experience as seamless as possible. Our comparison platform gives you instant access to quotes from leading providers, allowing you to make informed decisions with confidence. today and enjoy immediate coverage along with exclusive digital discounts!

The UAE car insurance market continues to evolve each year, with more personalized options and flexible payment plans becoming available. That's why we recommend staying informed about industry changes and regularly comparing quotes to ensure you always have the most competitive rates.

With Shory by your side, you can navigate the insurance market with confidence and drive with peace of mind knowing you've secured the right protection at the best possible price. Your journey to better car insurance starts here!