Car owners must have auto coverage in the UAE, but most drivers don't know what their insurance actually covers. Our research shows that comprehensive insurance can protect you up to AED 1 million for accident costs. Insurance companies rarely tell you this when they sell policies.

Your financial security depends on having the right auto insurance coverage. Most providers don't explain much about their comprehensive auto coverage options. They expect you to take the standard package without questions. Your premium rates can change by a lot based on your car type. Luxury car owners pay much higher prices than others. UAE insurers only allow annual payments. This creates a big upfront cost that catches many drivers off guard.

This piece for 2025 reveals everything in auto coverage that insurance companies keep quiet about. You'll learn about hidden coverage limits and the secret factors that affect your premium costs. This information helps new car owners and those renewing policies to get better protection without overpaying.

The two main types of auto insurance in the UAE

Auto insurance shoppers in the UAE will find two main types of policies. You need to know the simple differences between these options to make smart decisions about your vehicle's protection.

Third-party liability: what it covers and what it doesn't

Third-party liability insurance is the simple form of auto coverage you can get in the UAE market. This policy protects you against financial responsibilities from accidents you or someone driving your car might cause.

Third-party liability covers:

- Physical injury or death to third parties

- Damage to third-party property

- Legal liabilities from accidents

The policy has some big limitations. It won't cover any damage to your own vehicle, whatever caused it. Your car could get stolen, damaged in a fire, or hit by natural disasters, and you'd pay all repair or replacement costs yourself.

"I often recommend third-party insurance for older vehicles with lower market value," explains one insurance expert. "The money saved on premiums might justify the risk for some drivers."

Third-party insurance leaves out coverage for intentional damages, accidents that happen under alcohol influence, and incidents during wars or natural disasters.

Comprehensive coverage: full protection explained

Comprehensive auto coverage offers better protection and has everything third-party liability covers plus protection for your own vehicle. Vehicle owners get real peace of mind with this insurance.

Comprehensive auto insurance typically covers:

- Your car's damage from accidents (whatever caused it)

- Third-party liabilities (property damage and injuries)

- Vehicle theft

- Fire damage

- Natural disasters (floods, earthquakes, storms)

- Vandalism and malicious acts

A big plus of comprehensive coverage is the financial protection up to AED 1 million during accidents. This protection goes beyond your car to cover passengers and sometimes even your personal items.

You can customize comprehensive policies with great add-ons like rent-a-car services, passenger coverage, and roadside help. The premiums cost more than third-party coverage, but most drivers find the extra protection worth the money.

Which one is mandatory by law?

UAE law says every vehicle must have at least third-party liability insurance. This rule makes sure all drivers can pay for damage they cause in accidents.

The Roads and Transport Authority (RTA) won't register your vehicle without valid insurance. Driving without insurance can lead to heavy penalties.

Third-party might be the minimum legal requirement, but many UAE financial institutions won't let drivers choose this option with an outstanding car loan. Lenders want comprehensive coverage to protect their investment in the vehicle.

Comprehensive coverage gives much better protection for newer or valuable vehicles. Premium differences between these types change based on your car's make, model, and year. To name just one example, a 2017 Honda City's annual cost ranges from AED 1,092 to AED 1,680 for comprehensive coverage, while third-party liability costs AED 630 to AED 787.50.

Your final choice should match legal needs, your car's value, and how much risk you're willing to take. Cars less than seven years old do better with comprehensive coverage, even though it costs more upfront.

What insurance companies don’t tell you about coverage limits

Auto insurance companies don't tell you everything that's in the fine print. This could leave you exposed financially. You need to look deeper than what most providers want to find out your auto insurance policy's real coverage limits.

Hidden caps on third-party property damage

Your third-party liability policies usually cap property damage coverage between AED 250,000 and AED 500,000, but insurance providers rarely mention this. The amount seems like a lot until you see the cost of luxury vehicles on UAE roads.

Picture this: you accidentally damage a high-end sports car worth AED 1 million. Your standard third-party coverage would pay only half the repair costs. You'd have to pay the rest yourself. Most drivers don't know about this big gap until they face such a situation.

Some insurers offer third-party property damage coverage as an add-on. They don't actively promote this option. Insurance companies should explain these limits clearly when they give you an auto coverage quote.

Passenger injury limits and exclusions

Insurance companies stay quiet about passenger protection too. Standard policies limit passenger injury coverage to specific amounts per person. The cap is usually AED 200,000, no matter what the actual medical costs are.

Drivers often learn about these passenger exclusions too late:

- Basic passenger protection might not cover family members

- Your domestic workers might not be covered while in your vehicle

- Some insurers limit how many passengers are covered

- Medical coverage might not include permanent disability compensation

Your policy might also have exclusions that void coverage when you use your vehicle for "business purposes." This includes carpooling with colleagues. Such a technicality could leave everyone in your car without protection.

Why your own car may not be fully covered

Many policyholders get a shock when they file their first claim. Your comprehensive auto coverage rarely covers what you paid for your car or what it costs to replace it.

Insurance companies use depreciation formulas that cut down payout amounts. A car you bought for AED 150,000 might be worth just AED 90,000 after three years. This is true even if similar cars sell for more in the market. You'll get paid based on this lower value, not your purchase price or replacement cost.

Your vehicle parts lose value faster too:

- Batteries lose 30-50% value each year

- Tires lose 20-30% value for every 10,000 kilometers

- Electronic parts lose 15-25% value yearly

Comprehensive coverage often won't pay for mechanical failures, electrical problems, or wear-and-tear issues. Sales representatives focus on policy benefits instead of telling you about these limits.

UAE insurers also charge deductibles (excess) between AED 350 and AED 1,500 per claim. You must pay this amount before your coverage starts. This means your actual protection is less than you might think.

Here's what you should do: Ask for detailed information about coverage limits, exclusions, and depreciation schedules before you buy or renew your auto coverage.

Add-ons that can make or break your policy

The right add-ons can turn a simple auto insurance policy into resilient protection that fits your needs perfectly. These extra options are what separate basic insurance from a complete auto coverage package.

Agency vs non-agency repairs

Your choice between agency and non-agency repairs will substantially affect your premium costs and repair quality. Agency repair ensures your vehicle is serviced at the original manufacturer's workshop using genuine parts. This option comes built-in for the first three years. After that, you can add it as an optional feature at a higher premium.

Agency repair helps luxury vehicle owners and cars under warranty maintain their dealer service history and warranty validity. In stark comparison to this, non-agency repair sends your vehicle to insurer-approved workshops. These workshops offer lower premiums and usually fix your car faster. They use aftermarket parts that insurance companies have tested to meet quality standards.

Car rental and roadside assistance

A car rental coverage gives you a replacement vehicle while mechanics repair yours. This keeps your daily schedule on track. Roadside assistance is a vital add-on in the UAE's harsh climate. It provides towing, flat tire changes, fuel delivery, and battery jump-starts.

Most complete roadside assistance packages work around the clock. You can use these services without filing an official claim—which helps you keep your no-claim bonus. Small vehicles cost about AED 32 per day, while premium vehicles run around AED 47 daily.

GCC coverage and off-road protection

GCC coverage lets you use your policy benefits in Gulf Cooperation Council countries - Bahrain, Kuwait, Oman, Qatar, and UAE. This add-on helps frequent regional travelers and meets legal requirements when crossing borders.

Your policy might cover only third-party liability or include damage to your own vehicle in GCC countries. Off-road protection matters a lot to 4WD vehicle owners. It covers desert adventures, but you should check what's excluded, like dune driving.

No-claim bonus and how to keep it

UAE Insurance Authority rules say safe drivers get good discounts through the no-claim bonus (NCB). You receive a 10% discount after one claim-free year, 15% after two years, and 20% after three years.

The bonus stays with you when you switch cars or insurers. Just ask for a No-Claim Certificate. The NCB protector add-on lets you make some claims without losing your discount.

Smart selection of these add-ons based on how you drive and what you need creates a complete auto coverage package that protects you in almost any situation.

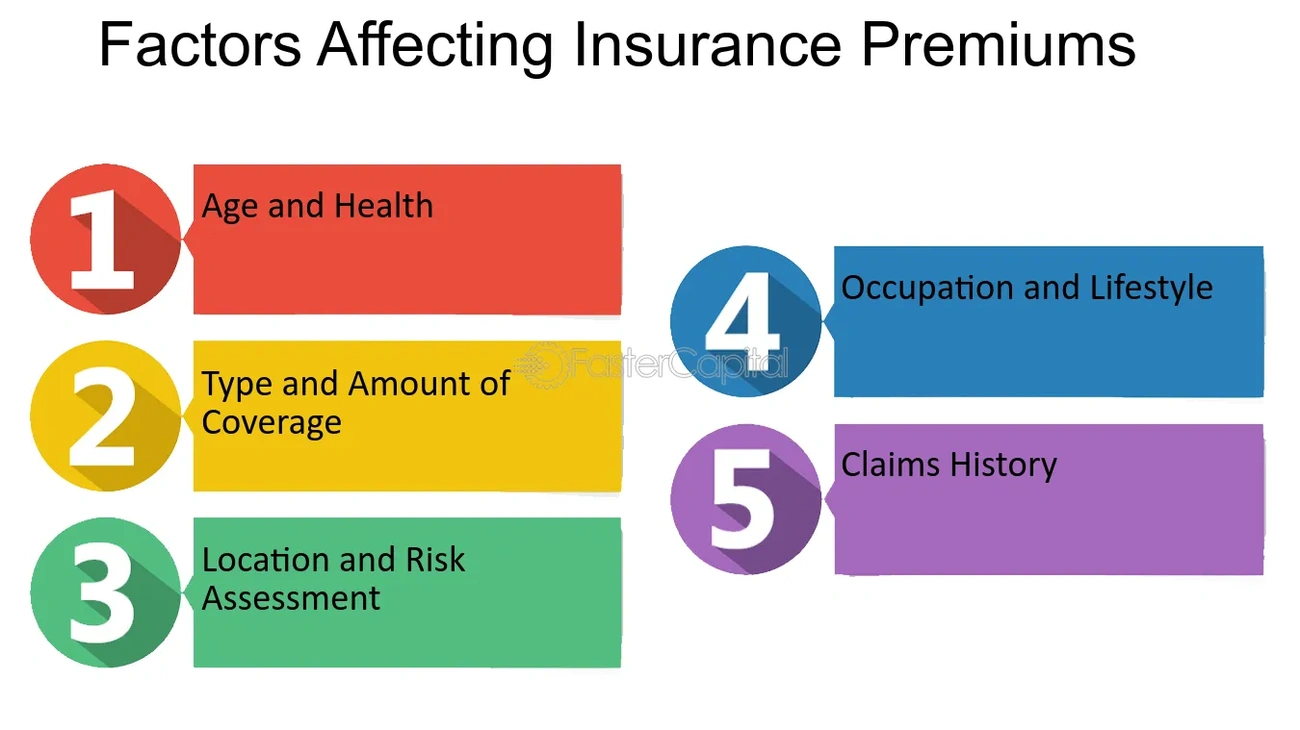

Factors that secretly affect your premium

Insurance companies look at many hidden factors each time you ask for an auto coverage quote. Better rates await you once you understand these variables.

Car age, model, and market value

Your vehicle's worth shapes how companies calculate your premium. Cars worth more than AED 300,000 usually have premium rates up to 2.75%. Vehicles under AED 100,000 might see rates of at least 3.25%. Your car's age matters in two ways. New vehicles need higher premiums because they cost more to replace. Very old cars might also need higher rates because their parts are hard to find.

The type of car you drive adds another layer to pricing. Luxury and sports cars cost more to insure than family vehicles. This is a big deal as it means that repair costs at authorized dealers are more expensive than local garages. A German car will need higher premiums than a Japanese model at the same price because repairs cost more.

Driver age and driving history

Your age bracket changes your auto coverage costs. UAE drivers under 25 pay the highest premiums. The good news? Premiums usually drop after you turn 25. Drivers between 30-50 years enjoy the best rates. Drivers over 50 often pay the lowest premiums because they take fewer risks.

Your time behind the wheel matters too. New drivers pay up to 18% more than those with just one extra year of experience. Your accident history and traffic tickets can override everything else. These issues might reset your premium to beginner levels, whatever your age.

How insurers calculate risk behind the scenes

Modern insurers use complex math models to assess your situation. Newer companies often use flat-rate pricing that spreads costs unfairly across customer groups. Most UAE insurers check your credit score too. About 95% of them look at credit history to set rates.

Where you live in the UAE affects your premium by a lot. People in Abu Dhabi might pay up to 25% more than those in Dubai, Sharjah, or Ajman. Areas with more people, higher theft rates, or bad weather always face higher auto insurance costs.

How to get better auto coverage quotes in 2025

Smart planning and insider tips will help you get the best auto coverage in 2025. The digital world of insurance has changed how we get better quotes. Success comes from knowing the right places to look and showing insurers you're a low-risk customer.

Compare quotes from multiple providers

You no longer need to call each insurer for quotes. AI-powered comparison tools have changed everything about this process. The RTA's Insurance Matchmaker 2025 platform looks at your driving patterns and gives you quotes that fit your profile. This smart system will give you rates that reflect your actual risk level.

The timing of your quote request matters. UAE Central Bank data shows you can save up to 20% by renewing your car insurance between November and February. Insurers compete harder for business during these slower months, which creates a perfect chance for drivers to save money.

Don't jump at the first quote you see. Shory lets you look at many providers at once, so you can see all your options. Getting different quotes helps you understand what's really available in the market.

Use a broker to negotiate better deals

Many drivers miss out on the unique benefits insurance brokers provide. These experts know insurance products inside and out and take time to understand what you need. They work independently from insurance companies, which means their recommendations stay unbiased.

Brokers have special access to deals you won't find anywhere else. Their relationships with major insurance companies often mean rates that are 10-15% lower than what you'd get on your own. This comes from the large volume of business they handle and their long-standing industry connections.

Brokers also handle all paperwork and support your claims. You can relax at home while they manage everything through online meetings or phone calls.

Avoid common mistakes when requesting an auto coverage quote

Drivers often hurt their chances of getting good quotes through simple mistakes. Check all your information before submitting it—wrong or missing details lead to bad quotes and might get your claims rejected later.

The biggest mistake is hiding important information. If you forget to mention past claims or give wrong car details, insurers might call it fraud and deny your claims. Insurance contracts require complete honesty from customers.

Price isn't everything when choosing coverage. Many people focus only on cost and end up with protection that falls short. Find the right balance between premiums and deductibles to keep your costs manageable when you need to file a claim.

Conclusion

Auto insurance in the UAE needs more than just basic understanding. This piece reveals everything about auto coverage that insurance companies usually keep quiet. You should know about hidden coverage limits and the factors that secretly affect your premiums to make better decisions.

The gap between third-party and comprehensive coverage goes way beyond the price difference. Third-party liability meets legal needs, but comprehensive coverage gives you much better protection against unexpected events. Policy add-ons can turn simple protection into coverage that fits your exact needs.

Complex algorithms and risk assessments often hide the real factors that affect your premium rates. Armed with this knowledge, you can now approach insurance talks with more confidence. A good grasp of these elements helps you get better rates and the right coverage levels.

Taking time to get quotes from multiple providers really pays off. Brokers are a great way to get deals that aren't available to everyone else. Being accurate and honest when asking for quotes stops future claim denials and gets you the most suitable coverage options.

Auto insurance isn't just a legal need in the UAE—it protects you from potentially huge costs. The right coverage needs proper thought instead of quick decisions. This guide will help you direct your way through the UAE's auto insurance world of 2025 with confidence and secure better coverage at fair prices.