Off-road Car Insurance Dubai - Do You Need One?

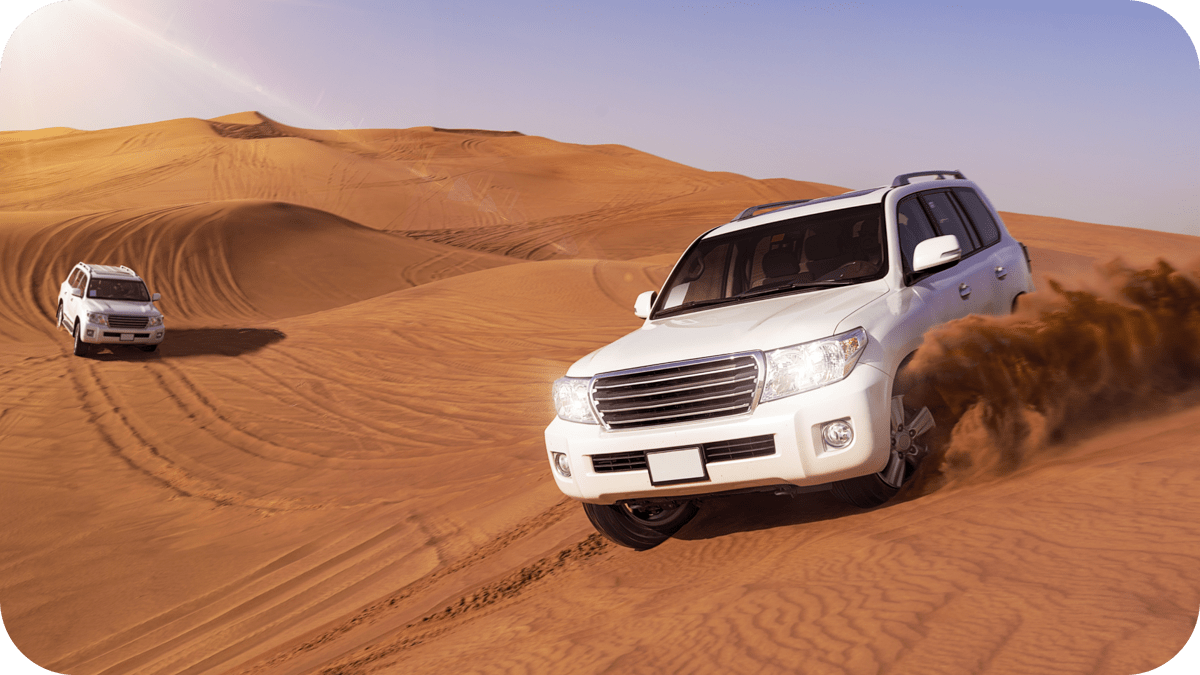

If you love the thrill of driving on the sand dunes or amongst the rocky hills, you know how liberating it feels to escape the traffic and explore the open spaces. But you also know that off-road driving can be risky for your car and that regular insurance plans don’t cover the damages that might happen in the desert. That’s why you need a car insurance policy with off-road coverage, so you can enjoy your adventure without worrying about your car. In this article, we’ll tell you more about off-road car insurance Dubai and why you need it.

What is off-road driving?

Off-road driving is when you drive your car on a track that is not a paved road, such as on sand or across rocks. This is very popular amongst the residents of Dubai and the rest of the UAE, where there are many desert activities to choose from.

What do you need for a safe off-road driving experience?

Before you hit the road, make sure you have everything you need for a safe and fun off-road driving experience:

-

A four-wheel drive car that can handle the terrain.

-

A full tank.

-

Tires that are suitable for off-road driving.

-

Essential equipment like an air compressor, a tow rope, a spade and a spare tire.

-

A first aid kit.

-

A mobile phone with a car charger.

-

Off-road add-on cover.

What is off-road car insurance?

Off-road add-on is like an extension of the basic car insurance that can be added to a comprehensive car insurance policy to cover dune bashing and driving in the rough terrains of the UAE. In some policies, this feature is a part of the standard plans. The off-road cover is meant to guarantee extra coverage if the car gets damaged while driving off-road since off-roading sometimes may not be a part of the original cover.

What are the benefits of off-road car insurance Dubai?

Some of the benefits of off-road car insurance Dubai that you may like to refer to are:

-

Emergency roadside assistance: If your car breaks down in the desert or somewhere far from the city, off-road car insurance cover will help you get the assistance you need.

-

Coverage for car damages: Driving on rough roads can cause your car to break down, get dented, or have some parts damaged. Off-road car insurance covers these cases.

-

Coverage for bodily injuries: Off-road car insurance also covers any injuries that you might sustain while driving off-road.

How do I know if my car insurance covers off-road?

To find out if your car insurance covers off-road, you need to read the terms and conditions of your policy carefully. Some factors that affect this coverage are: your age, your car’s age and type, and whether you drive off-road within the city limits. You also need to check how much coverage you have, as off-road car insurance has some limitations, such as:

-

Roadside assistance for a limited distance: Most policies include roadside assistance for off-road driving, but only for a certain distance from the main road. You need to check how far this distance is.

What does off road car insurance cover?

Off-road car insurance covers various damages that might happen to your car, such as:

-

Accidents and injuries while driving off-road

-

Damage to headlights

-

Damage to the windshield

-

Damage from camping overnight

-

Damage to audio equipment

-

Personal property damage

-

Natural disasters

What are the exclusions that off-road car insurance does not cover?

Off-road car insurance does not cover everything and some of its exclusions are usually:

-

Damages caused by your negligence.

-

Driving a car that is not suitable for off-road driving.

-

Making any changes to your car without approval.

-

Damages from illegal activities.

-

Off-road racing.

What should I consider when purchasing off road car insurance cover?

When you buy an insurance policy with off-road coverage, you need to pay attention to the limitations of the policy. These limitations can depend on:

-

The age of your car.

-

The type of your car; High-performance 4x4 cars have different options than basic 4x4.

-

Your age.

-

The range of roadside assistance. You need to know how far you can drive from the road and still get help.