Owning multiple cars in the UAE is not uncommon. From Dubai's luxurious streets to Abu Dhabi's vibrant avenues, the need to ensure proper coverage for all your vehicles becomes paramount and insuring multiple cars in the UAE might seem like a complex task. But with the right guidance, you can navigate the process seamlessly. This article serves as your comprehensive guide to insuring multiple cars in the UAE while maximizing savings and coverage.

1. Understand the Legal Mandates

Before diving into the world of multiple car insurance, it's crucial to comprehend the legal requirements. In the UAE, it's mandatory to have at least basic third-party liability insurance for every vehicle on the road. This insurance covers damages or injuries caused to a third party due to your vehicle's involvement in an accident. Therefore, when insuring multiple cars (as per the defined limit), ensure that each one adheres to this fundamental legal requirement.

2. Assess Your Needs

Each vehicle in your collection might serve a different purpose – from daily commuting to weekend getaways. As such, assess your usage patterns and specific needs for each car. This evaluation will help you determine the type of insurance coverage required.

3. Research Insurance Providers

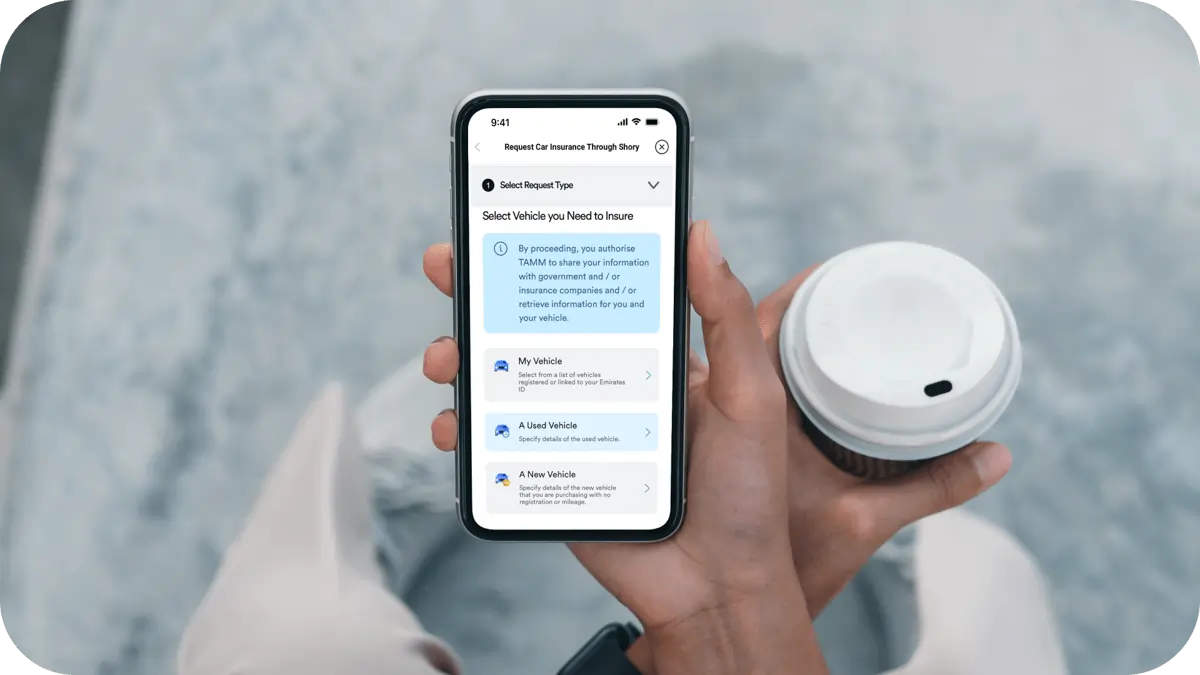

Shory.com has a wide array of car insurance providers, each offering different plans, coverage options, and pricing structures. You can explore your options from our list of reputable insurers that have a history of reliable customer service and efficient claims processing. Online reviews, recommendations from friends or family, and industry reputation should guide your selection process.

4. Opt for Fleet Insurance

If you own a larger number of vehicles, consider exploring fleet insurance options. Fleet insurance is designed for businesses or individuals with multiple cars, providing a streamlined approach to managing insurance for all vehicles under a single policy. This option often results in reduced administrative hassle and easy management of the vehicle policy. If you want to get your fleet entering the UAE, then you can explore Shory Aber for Business to explore your needs.

5. Evaluate No-Claims Discounts

Maintaining a clean driving record across your entire fleet can lead to substantial savings. No-claims discounts reward policyholders who don't make claims during the policy period. When insuring multiple cars, inquire about the availability of these discounts and how they might apply to your situation.

6. Understand Excesses and Deductibles

Excesses and deductibles refer to the portion of a claim you're responsible for covering before the insurance kicks in. When insuring multiple cars, carefully review the excess amounts associated with each vehicle. Opting for higher excess amounts might lead to lower premium costs but also means you'll have to bear a larger portion of the cost in the event of a claim.

7. Regularly Review and Update

Your insurance needs might evolve over time due to changes in your vehicle fleet, usage patterns, or personal circumstances. That is why you must regularly review and update your insurance policies to ensure that they align with your current needs. This proactive approach guarantees that your coverage remains adequate and relevant.

Conclusion

Insuring multiple cars in the UAE demands a strategic approach that considers legal requirements, individual vehicle needs and cost-effective solutions. By understanding the regulations, conducting thorough research, and making informed decisions about coverage types and providers, you can safeguard your entire collection while optimizing savings.